When I talk to our buy side clients I hear some common themes. They are undertaking more complex investment strategies, involving more multi asset class, multi-currency portfolios. The number of curves they need for valuation and risk calculations is growing. And many financial institutions rely on spreadsheets to deal with derivatives calculations that their core systems cannot handle effectively.

Of course, spreadsheets offer incredible power and flexibility to investigate potential investment strategies. But they have a dark side. With that flexibility comes a lack of control and studies consistently show that the majority of spreadsheets contain material errors. Firms need to be aware of this risk and be proactive about controlling it in order to safeguard their businesses.

One big source of risk is that as investments strategies and financial markets have become more complex, the complexity of spreadsheets has also grown. A typical spreadsheet to handle calculations for a small multi-asset class, multi-currency portfolio can contain over sixty sheets. These sheets contain market data, reference data, curves and volatility surfaces as well as the trades. When a spreadsheet becomes this complex, the only person who truly understands it is the person who created it.

For many leading institutions, the solution has been to lessen their reliance on spreadsheets and introduce a valuation and risk platform. This approach is helping them better manage risk in a landscape where calculations are becoming more complex and emerging regulations are introducing stringent risk data aggregation and reporting requirements that would be very difficult to meet using Excel alone.

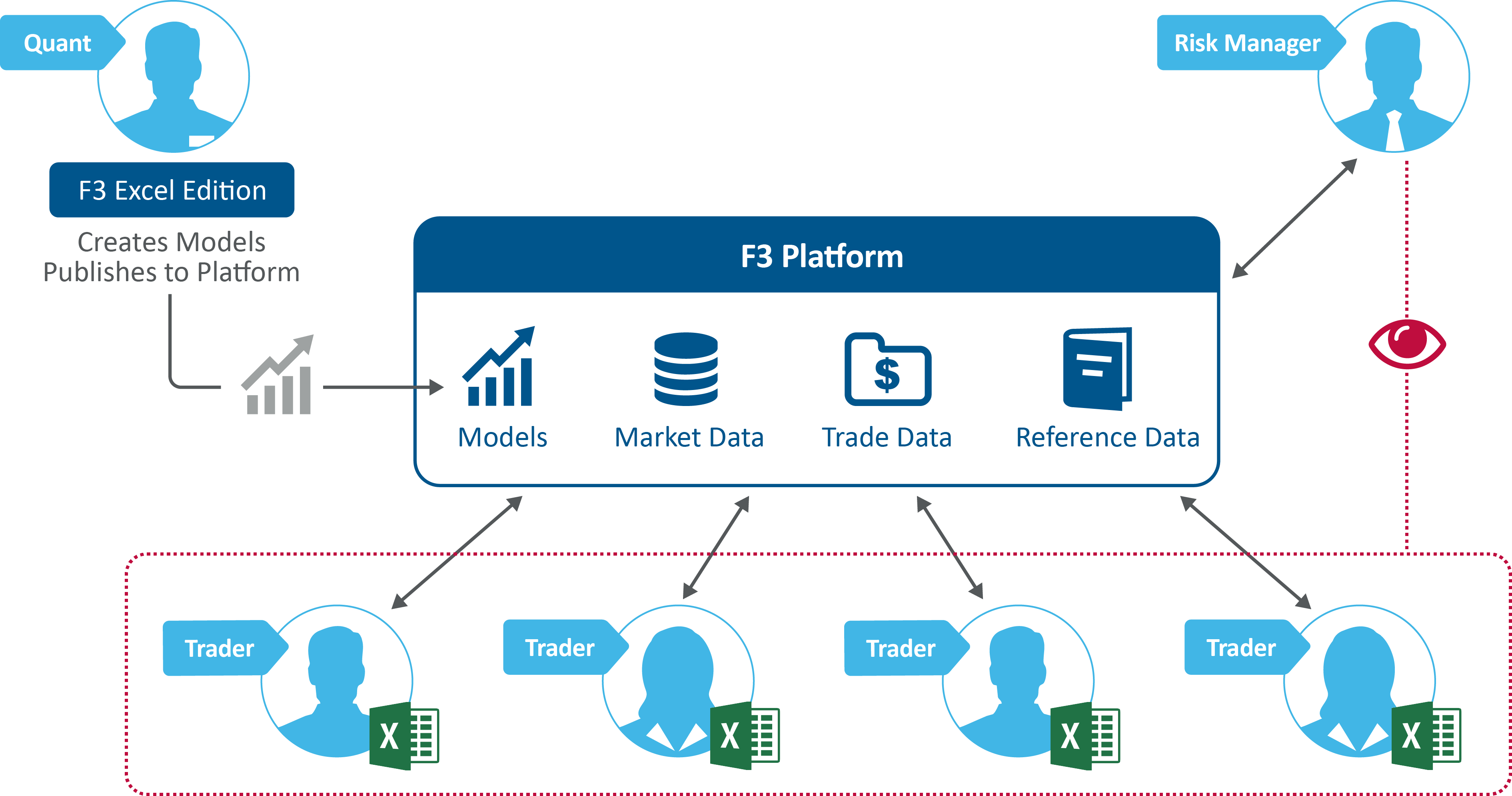

FINCAD’s F3 Valuation and Risk Platform fosters improved collaboration between quants, traders, portfolio managers and risk managers. Quants are able to create and verify market models, then publish trusted models to the F3 platform. Changes to models over time are tracked and viewable, helping you understand how these modifications affect your valuation and risk numbers. This way, all stakeholders involved can consume trusted market models, leading to consistent results and a reduced risk of costly errors.

And for situations where the flexibility and power of a spreadsheet are needed, those same models and trades can be used to drive ad hoc analysis through Microsoft Excel.

In addition to facilitating compliance, using a robust Valuation and Risk Platform is an essential enabler of competitive advantage. Financial institutions that have strong risk management systems and practices in place are better positioned to attract investors and generate better performance.

For more information on how to achieve competitive advantage using a valuation and risk platform, view our on-demand webinar, Valuation and Risk Best Practices.