The outlook for economic impacts of the coronavirus pandemic remains uncertain. But we are seeing the US Fed and many other central banks taking drastic steps to stem deflation and stimulate lending. US interest-rates are now almost zero, and modern expansionist monetary policy is in full effect with quantitative easing and the use of newly printed money for intervention in the open markets.

In the US, May CPI will be announced tomorrow on June 10, and we will get the official word on how the recent expansion of the Federal Reserve’s balance sheet is impacting consumer prices. But at the same time the idea that printing money will drive hyperinflation is not realistic. In the last financial crisis there were similar predictions, yet in the years which followed excess inflation did not occur.

Despite recently printing trillions, and controversially purchasing even high-yield assets, the majority of the Federal Reserve's balance sheet expansion has so far been in the form of currency swaps with other central banks. By adding currency swaps to their balance sheets, a global and systemic inflation of the available money supply and low interest-rates are intended to both stimulate lending and combat short-term deflation.

Increasing the monetary supply without causing excessive inflation in the long-run is not necessarily a paradox either. It was even predicted in the Keynesian theory of a liquidity trap, where interest-rates near zero cause fear that leads to hoarding of cash, which offsets inflation. However, it seems the expansion of the federal balance sheet is now a strong driver of the preference for investment over savings, and may demonstrate the ability of the federal monetary policy to push the economy into an inflationary phase despite poor outlooks in the underlying fundamentals like GDP growth and employment numbers.

For an indication of the way things are headed we can use the par rates on inflation swaps. US CPI Zero-coupon inflation swap (ZCIS) rates for 1 year maturity have recently gone negative due to the economic recession earlier this year, but they have since rallied and are now swinging back positive for the first time since early March. Commodities, which also typically follow the inflation cycle to some extent, are showing some gains. For instance, oil is now rallying since severe declines in May, signaling an increase in demand which may be enhanced in price terms by inflationary policies.

Does this signal that we are ready to return to steady inflation and higher demand? If so, here are some of the strategies employed in capital markets for a re-inflation of the economy:

ZCIS instruments are a straightforward way to get exposure to the inflation index, but can be illiquid and expensive as well as having the downside of lower-than-expected inflation. Unfortunately, there is also a total lack of instruments for structured strategies in the US CPI underlying, though it may be possible to trade inflation options in other currencies. Another aspect to consider is that it is not clear how and when Federal Reserve policies will directly impact the consumer prices or cost of living calculations that are used to determine the inflation index.

Traditionally many other asset classes like currency, precious metals, and other commodities like real estate and oil have been used as a proxy for inflation. Precious metals strategies can be structured for sufficient leverage, but generally don’t hedge inflation very well in the long-term and are subject to more drastic cycles and opportunity cost that make it a poor choice for long-term investment. In the short-term the gold run-up may just be fear and the belief that it will protect from inflation, despite the fact that the inflation cycle for gold is far too long to be the main price-driver in the near-term.

In the current climate, one must carefully consider how sectors will react to inflation of the money supply. For example, while USD is expected to decline from policy inflation, it is also regarded as a safe haven currency, sparking short-term demand that will offset this decline. Over the longer term, USD declines may be inevitable, though a weaker dollar is also a significant benefit to manufacturing industries ranging from aerospace, oil, tech, automotive and more, which will further boost equities.

In the stock market a V-shaped recovery will still retain some of the unique supply/demand characteristics of a virus-wary populace, which could persist even into a policy-driven inflationary expansion. The federal intervention will target steady long-term inflation, but this will backdrop the real economic impact. As shown in the recent jumps in airline and tourism stocks, in this climate some sectors will respond more strongly to the reduction in the pandemic than inflation.

For fixed income investors, T-bills track inflation well and avoid capital risk. With the recent declines in interest-rates T-bills have risen sharply, and there may be opportunities to either short or use inverse index strategies to capitalize on inflation that eventually drives rates back up. Inflation-protected notes are also an investment with capital protection and an inflation-linked upside. Though the principal protections and lack of leverage limits the potential returns, and gives significant interest rate duration exposure.

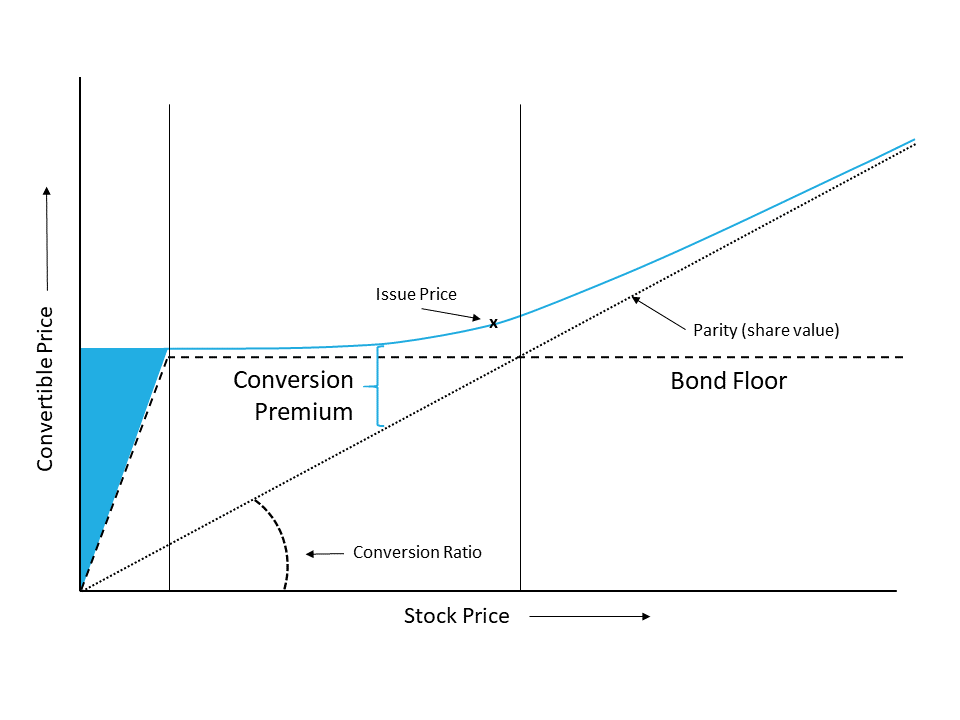

We can also use a more complex derivative for enhancing returns in an inflation economy, such as hybrids. Convertible bonds (CB) and preferred shares (PS) both have upside from the potential conversion into equity prices brought up by inflation. Hybrid securities require more complex modeling of the rates, equity, and credit factors, including the potential correlations. The tendency of correlation between equities and inflation is one of the reasons convertible hybrids do well. Though without being callable, they may come at a premium to preferred shares with less-certain dividends. However, both CB and PS suffer from rate risk in the event that policy rates trend back to normal levels, so it is important to get in at the right delta for sufficient equity exposure.

All of these strategies are still unleveraged, and will require significant capital investment to benefit from inflation. A leveraged position could involve short-fixed and long-equity return legs in an equity swap or futures position. An equity/bond spread position avoids tying up principal and gives upside to equity performance combined with positive policy rate exposure in the short-fixed leg. Even if the underlying equities do not rally, the increase of policy rates for inflation targets will compensate this. The major risk for the leveraged equity swap is the possibility of a sustained recession over the investment time horizon.

Investments offer many ways to protect money from inflation. But it can also be challenging to leverage the benefit of the effects of federal monetary policy simply due to the indirect way that inflation impacts the markets. Inflation always takes place on a longer time-horizon, but the monetary expansion of the Fed is driving towards inflation. Rather than fight the Fed, it is important to consider how your positions will payoff in the medium to long-term given the economic outlook of upcoming policy-driven inflation.